W-9 Compliance is an optional feature in Advocate that helps your brand meet US tax reporting requirements for participants who earn $599.99 USD or more in non-cash rewards (e.g., gift cards, products with USD value, etc.) in a calendar year.

Note: This is separate from the tax handling process used for cash rewards paid out through impact.com. Cash rewards require participants to submit tax forms and banking details directly via a secure tax interview flow built into your widget or microsite before earning rewards. W-9 Compliance, on the other hand, supports brands that issue non-cash rewards and want to track W-9 status for IRS compliance manually.

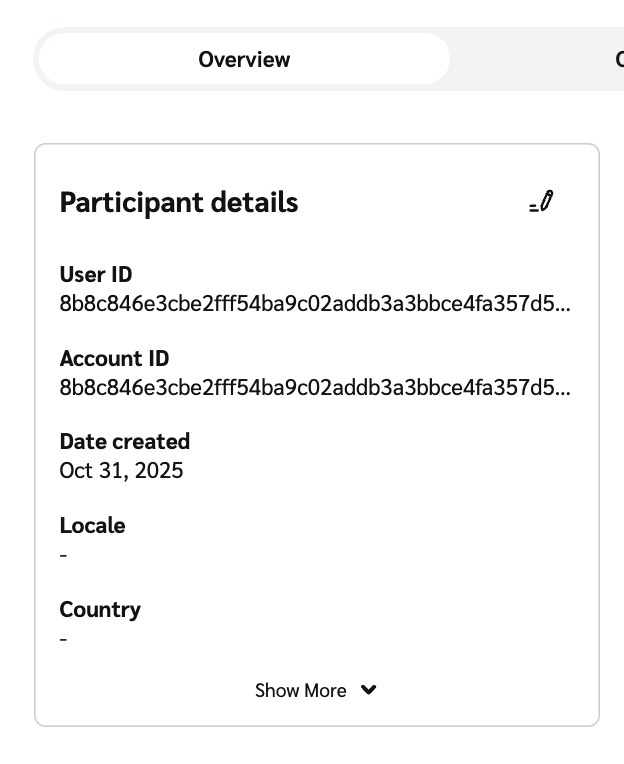

Track W-9 collection status for each participant within their profile.

See how to change participant's W-9 tax compliance status for more information.

Assign a taxable USD value to non-cash rewards (like gift cards or physical products) for compliance tracking.

Automatically place rewards into a pending state when a participant without a W-9 on file exceeds $599.99 USD in a tax year.

Advocate does not collect W-9 forms on your behalf when rewarding non-cash rewards.

Advocate does not store copies of W-9 forms.

This feature does not apply retroactively—rewards earned before enabling W-9 Compliance will not count toward the $599.99 threshold.

Your team is responsible for collecting and securely storing W-9 forms and issuing 1099-NEC forms if applicable.

To turn on W-9 Compliance for your account, reach out to our support team and let us know which option you want from the list below.

Regardless of which option you choose, participants who exceed $599.99 USD in non-cash rewards will automatically receive an email notification that a tax form is required.

This email can be customized to include:

Your preferred language or tone.

Specific instructions on how participants should submit their W-9 form to your team.

A point of contact or support information, if needed.

Customizing this message ensures your participants clearly understand the next steps and helps streamline your tax form collection process.

We recommend speaking with your legal or finance team to determine whether W-9 collection is required for your referral program, or if it’s already being handled through other systems.

W-9 Compliance is especially useful for brands that do not use cash payouts through impact.com and want a lightweight way to monitor tax eligibility for non-cash rewards. However, you remain responsible for collecting, securing, and reporting tax information in accordance with IRS guidelines.